The first posting reviews the CTAR area market for the past 10 years. During this time we’ve seen a tremendous development of our Charleston Area Real Estate market. In 1998 there were 7623 units sold, a sales volume of $1.2 Billion, an average sales price of $158,462, with 2941 units in inventory and an average month’s inventory of 4.63 months. In 2008 the market had 8893 units sold, $2.6 Billion in sales volume, an average selling price of $292,247 with 11382 units in the inventory and 15.36 months Inventory. In 2005 the market reached its highest unit sales and volume sales levels.

Let’s take a detailed look of the statistics between 1998 and 2008. The Greater Charleston area (CTAR MLS All Areas) in 1998 had 7623 Units Sales. In 2002 the market started to take off. The Units Sales increased from 8316 to a record high of 18075 in 2005 (an increase of 217% or 72% per year for 3 years.). In 2005 the Real Estate market reached an all time high Unit Sales. In 2006 there was a 1304 unit decrease to 16771. Then over the next 2 years the market dropped from 16771 to 8893 units or a decrease of 188% (average 94% decrease per year).

The Greater Charleston Market Area reached an all time high dollar Sales Volume of $5,022,485,847 in 2005 up from $1,207,959,788 in 1998 for a 415% increase over the 6 year period (Avg. 69% / year). From 2006 to the end of 2008 the total volume declined to $2,599,251,589 or 193% (Avg. 97% / year).

One of the most notable things about the Greater Charleston Area market is its ability to maintain a growth in the Average Sold price and Median Sold price through 2006 even as Unit Sales took a huge drop. Some markets around the country have seen sales price drops of 50%.

The average sales price increased from $158,462 in 1998 to $298,604 2006 or 188% (Avg. 20.9% over 9 years). The Average sales price declined to $292,247 in 2008 by 2.2%. The Median Sales Price for the area was $122,550 in 1998 and by 2007 it rose to $207,500 or 169% (Avg. 18.8% / year). The Median price fell to $200,000 in 2008 or 3.75%. We will see what 2009 brings in sales price decreases but, to date we have been able to maintain our home value on average for the whole area. We should also note that some price ranges have had more discounting and some CTAR areas have lost more value.

The Average Days on Market is primarily driven by the demand of homes compared to the supply of homes. In 2005 there were 18075 units sold with an average unit inventory of 4489 which resulted in a DOM of 45 days. In 2008 there were 8893 units sold with an average inventory of 11382 and 103 DOM.

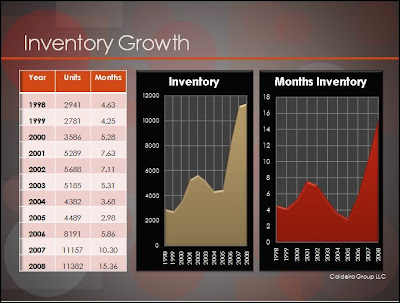

The Inventory grew from 4382 units in 2004 to 11382 units at the end of 2008 or 260% (65%/year for 4 years). At the height of the unit sales in 2005 the Months inventory was at its lowest point 2.98 months. By 2008 the average month’s inventory rose to 15.36 months. Months Inventory is the expected average time to sell a new listing. It is calculated by the amount of homes sold per month divided by the total unit inventory.

In the next posting we will look at the year 2008 by month and discuss the forecast for 2009.